Why seafarers need to stay away from ULIPS ?

ULIPS i.e. Unit Linked Insurance Plan Scheme has become a popular option among masses as it provides dual benefits of insurance and investment under one scheme. The premium paid to ULIPS gets divided in two parts – one part contributed to the insurance life cover while the other part gets invested in a fund of your choice.

Seafarers often find ULIPS a good long-term investment and end up investing their hard-earned money. But there are various downsides to this, which people are not aware about before making big investments.

Some of these are –

Complexity

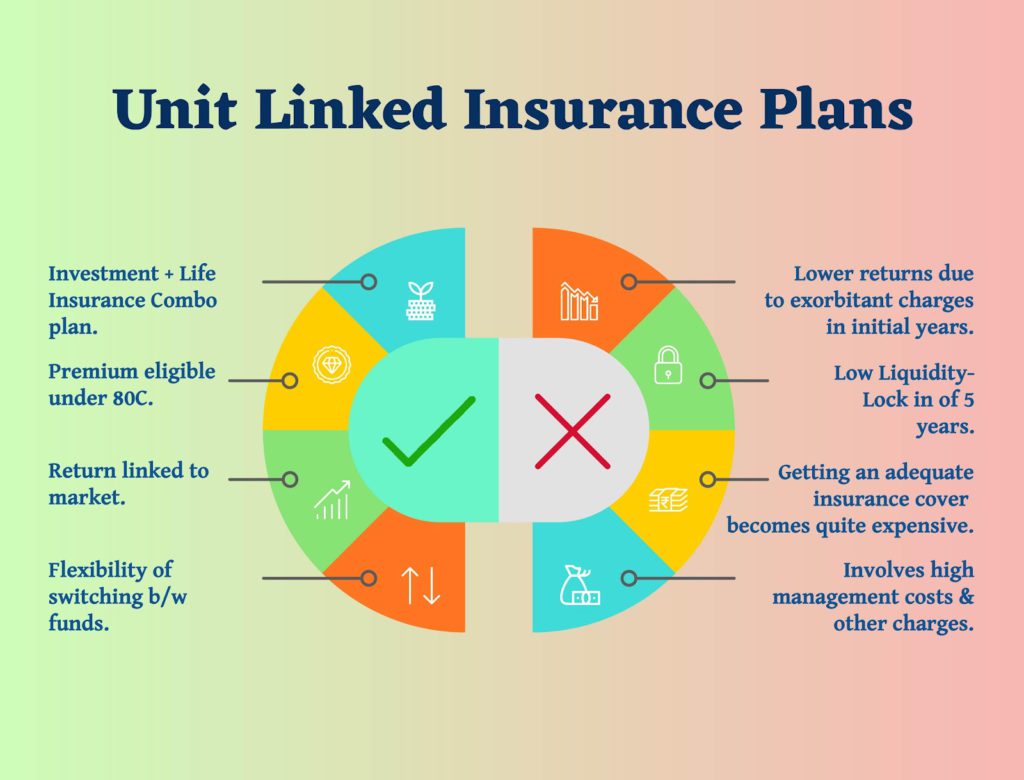

A seafarer should go by the premise – “ Always keep your investment and insurance separate.’’ But ULIPS brings it together causing a rise to complexities. It is difficult to calculate the exact return on your principal amount as there are too many over the top charges in case of ULIPS.

Suppose a seafarer wants an insurance cover of 2-3 crores. If he continues with ULIPS then the maximum cover he can opt for is 15-20 lakhs. So now he has to pay a premium of 1 lakh on the cover out of which 30 thousand will be deducted in the form of additional expenses, leaving only 65 thousand to invest.

Lack of transparency results in an uneven return on investment to the amount that has been used for investing. Also, the premiums charged for life insurance in ULIPS end up being much higher than term insurance plans. So, it is always better to choose a simple and single plan that either covers your insurance or investment perfectly.

Expensive

If you are told, ULIPS will make your investment more reasonable and safe, then you are absolutely misinformed.

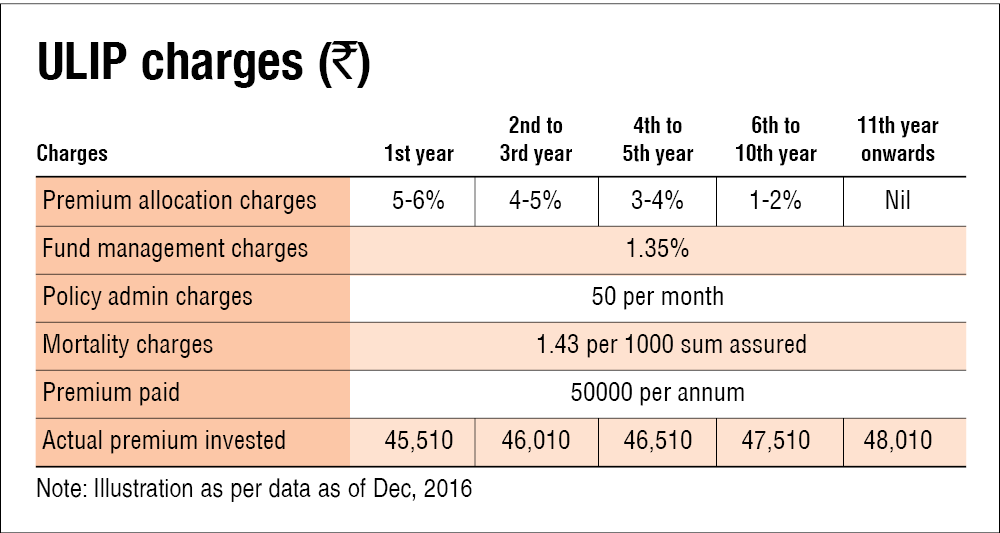

Suppose you invested 15 lakhs in ULIPS. The company will collect the amount and first they will deduct their own expenses and commission from the total amount paid by the investor. Then, a small portion of the amount will be invested in your life insurance cover while the remaining 60-65% amount will be invested in the market.

In the early years, ULIPS will provide a lesser profit than mutual funds due to market fluctuations and cost a considerable amount of premium in the beginning.

For example, if you want to buy an insurance cover of 2-3 crores under ULIPS then the premium amount to be paid can go up to 20-30 lakhs for a lock-in-period of 5 years. But if you buy a simple term plan even at the age of 30-32 years old, you will be required to pay 20 thousand per month for a cover of 2 crores.

Hence, due to high premium cost and less transparent system ULIPS goes down in the list of Investment Plans every seafarer should avoid. Another thing to keep in mind is that the roles of investments and insurance are so dissimilar, it is generally advised that they be maintained separately.

Disclaimer :- The opinions expressed in this article belong solely to the author and may not necessarily reflect those of Merchant Navy Decoded. We cannot guarantee the accuracy of the information provided and disclaim any responsibility for it. Data and visuals used are sourced from publicly available information and may not be authenticated by any regulatory body. Reviews and comments appearing on our blogs represent the opinions of individuals and do not necessarily reflect the views of Merchant Navy Decoded. We are not responsible for any loss or damage resulting from reliance on these reviews or comments.

Reproduction, copying, sharing, or use of the article or images in any form is strictly prohibited without prior permission from both the author and Merchant Navy Decoded.